Acquire – the right pieces for the right reasons

I have less to say here, but with Mitel just going private – again – it made think differently about Vonage’s moves. For a while now, CEO Rich McBee has positioned Mitel as a consolidator, acquiring both competitors and complementary pieces. That strategy makes sense given their market standing. Mitel will never become a Tier 1 player like MSFT, Cisco and Avaya, but could certainly become the leading Tier 2 player, and acquisitions were the way to do that. There were plenty of other Tier 2 competitors to choose from, along with an ocean of Tier 3 trying to hold their own.

Mitel has had a rocky history being both public and private – not just themselves, but also via the companies they’ve acquired. Going private again with Searchlight feels a bit like Avaya going private to restructure and later go public again, but it’s more about financial maneuvering than responding to changes in the marketplace. Nobody is perfect, but they needed two tries to take arch-rival ShoreTel, and going for Polycom seemed like punching above their weight. Mavenir never made sense, and there isn’t a desk phone vendor out there they didn’t like. Don’t get me wrong – Mitel is a major player with a solid cloud portfolio, but there sure is a lot of hardware in their asset mix.

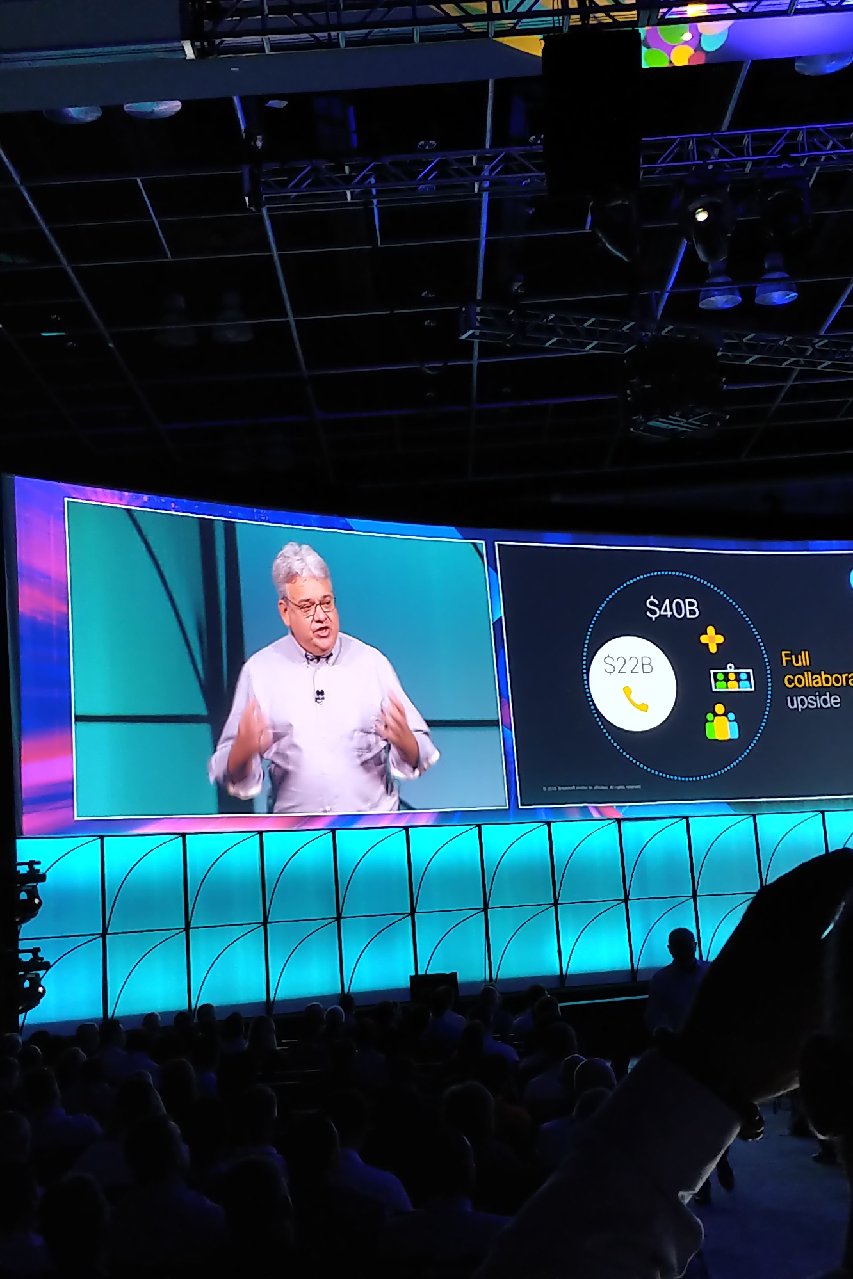

Most people think of Mitel when talking about consolidators in our space, but it seems to me that Vonage has done a better job with acquisitions. Everything happens faster with cloud now, and it’s almost impossible to have sustained success now just with organic growth. Under Alan’s vision, all their moves make sense, especially for the trifecta he talked about and Blair covered in her post. For UCaaS, they have mix of customers on BroadWorks and VBC, their proprietary platform. With BroadSoft in Cisco’s tent now, that’s going to present some challenges, but they plan to keep supporting both indefinitely. However, the future will be VBC, and as Alan explained, this is part of their “own the stack” strategy.

For the other two parts of the trifecta, they smartly acquired Nexmo, the next biggest CPaaS player after Twilio, and then NewVoiceMedia to take their CCaaS play to the next level, namely beyond their partnership with inContact. It might be enough to view these as standalone pieces, but the real end game is One Vonage, where the entire portfolio is integrated, with a heavy emphasis on programmable communications via APIs.

As Alan noted, over half their pipeline is for combined UCaaS and CCaaS, so there’s a strong rationale for this end game. More importantly, it’s been driven by market forces, not financial forces, and that’s why I think Vonage is holding the hot hand right now for being a consolidator. I say that in particular because Vonage’s moves haven’t been to consolidate the supply side by acquiring competitors. Rather, it’s been to acquire pieces that consolidate a value proposition that the market is buying now. I’ll take that scenario over the challenges Cisco will face with BroadSoft, or even Genesys and their play with Interactive Intelligence. Every scenario is different, but Vonage looks to be moving and executing with purpose.

3 things that could go wrong

I concur with Blair and Dave – and others at the event – that the candid nature of the Vonage team gave us a close look at what they have, and it was hard to come away not feeling good about their chances. They seem to have the right mix of technology, innovation, culture, leadership and financial strength to stay in the game for years to come. Many new players won’t make it, and others will be acquired or exit as the barriers to entry get higher and the remaining competitors get stronger. I believe Vonage will hang with whoever’s left, and as Alan says, at this point it’s all about execution. That said, I’ll balance things out with three wildcards that could make things much harder if they don’t execute to plan.

Costly S&M and branding

While residential VoIP is a race to the bottom, cloud offerings for the business market are an expensive undertaking. Currently, Vonage is spending 30% of revenues on S&M – Sales and Marketing. That may seem really high, but OTTs don’t have an installed base – those new customers have to be taken from someone else. Getting customers and keeping customers are two different things, and with Vonage telling us about their low churn numbers, they’re holding their own on the latter. The same actually applies to the former when considering S&M for their OTT competitors. RingCentral currently stands at 44%, and 8x8 is a whopping 60%. Alan noted that in dollar terms, their M&S spend is comparable to RingCentral, but that’s not being reflected in name recognition, so there’s room to improve there.

2. Losing the golden goose

Another risk factor would be golden goose from residential that frees up cashflow to maintain that spend level for S&M. Their business revenues may be growing at a faster rate than the YoY declines in residential revenues, but clearly that free money will be harder to come by. If Vonage wants to stay in both lines of business, at some point, they’ll need to up their investment to keep the residential business going. I’m sure they’ve thought this through, and the implication would be the need to complete their trifecta One Vonage integration ASAP. If that somehow gets bogged down with technology issues, GTM execution or culture clashes, the pressure will be on to somehow keep the business growth coming on its own merits.

3. What everyone else is doing

State of the competition. CPaaS is central to Vonage’s API-driven value proposition, so Twilio is the main target there. Having recently attended their SIGNAL event, I understand why their momentum is so strong, but it remains to be seen how deeply developers can take them into enterprises. I agree with Alan that Vonage is better equipped end-to-end to serve enterprise customers, but Twilio is hitting its stride now, and they want to succeed as badly as Vonage. For better or worse, I’ve long said that Vonage is the Kleenex of VoIP, and I would say the same about Twilio for APIs. They have great brand recognition, and Vonage is still trying to migrate upstream to enterprises, so the road won’t be easy. Finally, there are those pesky Tier 1s to worry about. If Cisco gets it right with BroadSoft, they’ll be even stronger, and Microsoft has its mojo back in enterprise. Trust goes a long way when picking a cloud partner, and Vonage will have to earn that to grow at the expense of those players. If they’re holding a full house, they’ll be fine, but if just two pairs, they’ll have to play the game more carefully.